- You have no items in your shopping cart

- Continue Shopping

Content

You can also use the software to print checks and streamline bill payments. Wave’s easy-to-read dashboard shows you your most important financial info at a glance. You and the rest of your financial team can jump on your account to check numbers and enter information, free of charge. Paid plans start at $15 per month, billed annually, and offer features that include multiple users, bulk updates, timesheets and sales tax tracking. Learn more about what Zoho has to offer with our Zoho Books review. Kashoo can be an excellent choice for an accounting service for startups because they offer a variety of plans that have significant potential to grow with your business.

The platform is an invoice management solution, above all else — and that can be a benefit or drawback in its own right, depending on what you need. Stay updated on the latest products and services anytime anywhere. Keep track of your mounting bills & expenses and the money flowing out. See your financials online anytime, anywhere on your computer, tablet or phone. Any connections between you, your bank accounts, and Wave are protected by 256-bit SSL encryption.

A Lack of Access to a Fuller Suite of Features

This individual and their team work with you on customizing your setup and monitoring your transactions so they’re accurately entered and categorized for tax purposes. They reconcile your accounts and close your books at month’s end to prevent errors. Plus, they’re available for questions during regular business hours. Finally, they generate the reports you need so you’re ready to prepare your taxes or hand them off to your accountant. Wave offers fee-based bookkeeping services, but they lack Intuit QuickBooks Live’s interactive quality. There are other reports, though, that aren’t so easy to understand.

- For this reason, many businesses hire bookkeepers or accountants to maintain or review their books.

- This costs $20 per month or $18 per month when billed annually.

- A dated interface, lack of mobile access, and the requirement to install the software locally keep it from receiving a higher score.

- Wave has a robust Help Center for self-service support, and they also provide email support for all invoicing and accounting questions related to their free features.

- We’ve done the research for you, and here are our top seven free accounting software packages.

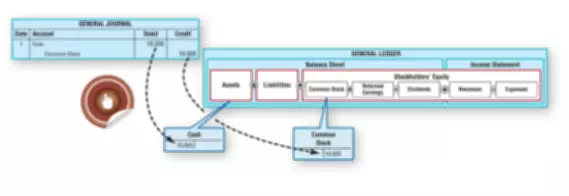

- Some specific topics covered in the syllabus include the trial balance, types of business transactions, and ledger accounts.

- Some apps also provide context-sensitive help along the way and a searchable database of support articles.

In addition, the accounting software allows small business owners to get a real-time view of their financial situation. This means they can quickly see how much money is coming in and how much is going out, and identify areas where they can cut costs or increase revenue. This understanding of the financial situation is essential to making sound business decisions and staying competitive in today’s economy.

CloudBooks: unlimited users, restricted invoicing for free

It helps accounting and bookkeeping for small business spent doing manual bookkeeping or preparing monthly reports by automating these processes entirely. CloudBooks is an online accounting software program that allows you to manage your online invoices, expenses, and projects. You can also view financial reports from any mobile device with their free app. Their platform allows for unlimited staff users, which means you can share access to your books as needed. Wave is one of only two online accounting services that you can use for free, unless you need payroll and payments, which you do have to pay for.

4 tips for starting your new financial year – Q City Metro – Qcity metro

4 tips for starting your new financial year – Q City Metro.

Posted: Fri, 03 Mar 2023 06:57:45 GMT [source]

Some, such as Patriot Software Accounting Premium, simply let you maintain descriptive product records. They ask how many of each product you have in inventory when you create a record and at what point you should be alerted to reorder. Then they actively track inventory levels, which provides insights on selling patterns and keeps you from running low. It has all the features you’d expect from an accounting package and we are working on adding even more. Zoho Invoice is one of the best options available when it comes to automating your invoicing workflow.

Which accounting system is useful for small businesses?

You can also view bills and expenses in a list or a more eye-pleasing gallery view. If you have other companies, Brightbook allows you to access them under one login. A client portal is also available to share transactions and invoices with your clients and accept online payments. You can even set your clients up with a sign-in to access information.

As I mentioned earlier, if you need to shift from one accounting application to another, your existing data will have to shift too. Some free accounting solutions make that process more convoluted and frustrating than others — bear that in mind when you pick your preferred platform. So in some cases, going with a free accounting solution might not be sustainable. Zoho Books is a robustly featured accounting solution tailored to help small businesses. Its free plan is restricted to organizations generating less than $50,000 in annual revenue, but if you qualify, Zoho Books can cover a lot of your bases. Lendio sets itself apart from other bookkeeping solutions with its dedicated bookkeeper services, but those services come at a hefty premium.

Get 100% FREE Accounting Software Today

See our step-by-step guide on how to import bookkeeping data into Wave here. Bank data connections are read-only and use 256-bit encryption. Wave is PCI Level-1 certified for handling credit card and bank account information.

- Accounting software is a way for businesses to track income and expenses, send invoices, track sales tax and create reports.

- If you’re looking for a comprehensive suite of accounting features and don’t mind working with a relatively stripped-back program, consider checking Brightbook out.

- Upgrading your plan for a one-time fee of either $49 or $99 gives you lifetime access to 27 training videos on bookkeeping basics and financial statements.

- It’s been one of the best decisions I’ve made when it comes to making sure my accounting is on point.

- We considered cost, scalability, ease of use, reputation, and accounting features.

- If you are looking for straight off-the-shelf functions, the prices start as low as $7.50 per month.

Read our article on how to use Excel for accounting to learn how to track invoices, bills, COGS, and inventory costs. ZipBooks is also a scalable option on this list—but it’s not as scalable as Zoho Books. Upgrading to ZipBooks Sophisticated can give you advanced accounting features, though not as advanced as Zoho Books Ultimate. We recommend choosing ZipBooks over Zoho Books if there’s no need for advanced accounting features like advanced analytics, multi currency handling, and real-time reporting. And many of those options are thoughtfully tiered — offered at reasonable prices that are appropriate for your business’s scale.

Refreshingly simple bookkeeping

More importantly, we took into consideration whether the software could automatically track the COGS and compute the cost of ending inventory. GnuCash has a spreadsheet-like dashboard, which shows a list of your accounts and income and expenses. The dashboard looks a bit outdated, and it may be difficult to navigate, especially if you’re used to cloud-based software. As your business expands, it’s almost bound to scale out of your free accounting software’s limited capabilities.